How could it happen? On March 4, the board of Suntech Power (STP) fired its founder and chairman, Zhengrong Shi, replacing Shi with Susan Wang, a Suntech director. This was the second demotion for Shi, who lost his job as chief executive officer last August.

Suntech reported losses of more than $1Billion in 2012 after making a profit in 2011. And, Suntech is being forced by eight banks into bankruptcy after defaulting on $541 million of convertible bonds due March 15. The company’s finances are being investigated in China.

Suntech reported losses of more than $1Billion in 2012 after making a profit in 2011. And, Suntech is being forced by eight banks into bankruptcy after defaulting on $541 million of convertible bonds due March 15. The company’s finances are being investigated in China.

A global supply glut and cuts to government subsidies for alternative energy in Europe has spurred losses for Chinese solar manufacturers since 2011. Suntech, with the largest industry manufacturing capacity, but also the largest debt of any Chinese module maker, was particularly vulnerable to the price and demand pressures in the solar market.

Suntech’s downfall is as unimaginable as the New York Yankees going to the minor leagues…. Dr. Shi is the superstar scientist, educated in prominent Western universities, who founded Suntech in 2001. Suntech was the highly visible, successful international growth company created in the modern Chinese way, with world-wide market presence, leading technology, and the world’s largest factory capacity financed from state backed lenders. The results have been stunning for a decade: listing on the New York Stock Exchange in 2005, number three word-wide photovoltaic supplier by 2006 as well as supplier to the Olympics, and the world’s solar module market share leader by 2009, with modules that are world class in efficiency. With Suntech in the lead, China was clobbering the U.S. and Germany and all comers in solar.

The right stuff

What will happen to Suntech and its 2 gigawatts of solar capacity? For the long run, Suntech has all the right stuff; leading technology, modern manufacturing capacity that will serve the market for a decade or longer, and world wide application and sales acumen.

Excess dynamic random access semiconductor memory (DRAM) in the 1980s and excess optical fiber data transmission capacity in the 1990s resulted in a surge in development to utilize the unused capacity, as well as a surge in acquisitions and industry consolidation to buy and deploy the assets for a fraction of their cost. I predict the same will happen with Suntech.

On the asset acquisition side, already reports are surfacing of interest from the government of Wuxi, where Suntech is headquartered, to find a buyer or financier. Rumors of Warren Buffet’s interest have been reported. I expect more, quality players will circle the field where Suntech plays, looking to garner a leap forward in capability and capacity, at a fraction of the normal cost.

A bright solar morning ahead

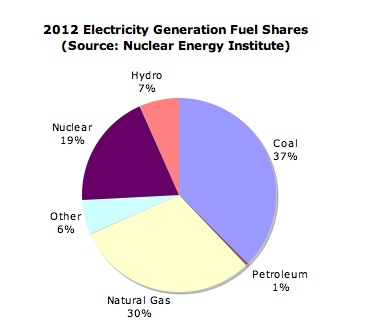

At post bankruptcy prices, the marginal cost to produce a photovoltaic panel with Suntech’s factories could be as low as 10 to 20 cents per kilowatt, essentially just the price of the raw silicon, currently dropping quickly, plus a small operating cost. This is a whopping advantage in the market, and a huge accelerator for large scale solar installations. At 15 cents per kilowatt, solar is cost competitive with utility scale gas fired electricity plants. As companies, governments and utilities look at ways to insulate themselves from future fuel cost shocks, solar from Suntech’s factories is going to look super attractive.

As Shi Dinghuan, president of the Chinese Renewable Energy Society and an adviser to the State Council, told Bloomberg News, “the government won’t let this well-known company enter catastrophe easily.”

The days currently look dark for Suntech and the solar industry in total. But today’s excess capacity and pricing pressures are setting the stage for an amazing growth spurt in the next several years, putting a new light on the solar market.